Realizing the significant of this new important event and gap it could cause in the literature of emerging market like Malaysia this study is motivated to investigate the impact of the GST announcement and implementation on the Malaysian stock index and provides evidence by first examining the pre- and post-GST announcement on the Malaysian stock market index volatility. To get GST inclusive amount multiply GST exclusive value by 106.

Once the implementation of GSTVAT is completed in both Malaysia and China then the question becomes whether the indirect tax systems throughout the region will start to develop greater levels of commonality and maturity in a way in which we see in Europe.

. Where you make savings due to the repeal of the Sales and Services Tax and the introduction of GST you must pass this on to your customers or face heavy penalties. However this decision is likely to be implemented in 2022 or 2023. SMEs contributed 363 per cent to Malaysias.

The implementation of the goods and services tax GST in Malaysia on 1 April 2015 was part of the Malaysian governments taxation reforms aimed at improving the collection of revenue and reducing the countrys budget deficit. Just multiple your GST exclusive amount by 006. For example Malaysias GST system borrows from countries like Singapore while the.

This study presents some of the major. In Malaysia the goods and services tax GST was introduced on April 1 2015. Businesses have generally adapted well to the implementation of the tax.

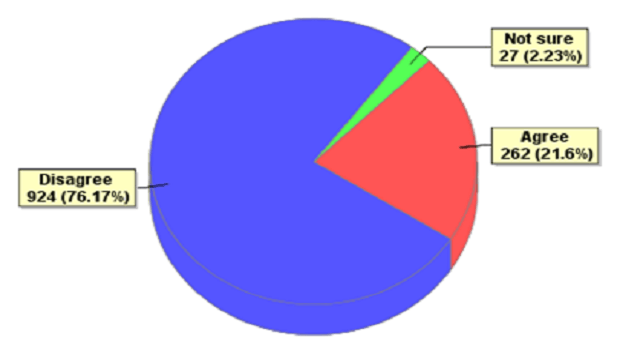

This result shows that 277 GST awareness has an effect toward problems in G ST implementation. What is GST. Both the Malaysia GST and Singapore GST are broadly.

The introduction of the Goods and Services Tax GST can be one of the most difficult reforms a government undertakes. Implementing a goods and services tax GST regime can be a lengthy and turbulent process. With GST implementation revenue collection increased by about 3 per cent to 2197 billion Malaysian Ringgit MYR and reduced the fiscal deficit to 3 per cent of GDP in 2017.

From 1960s to 1970s only a few countries adopted GST and most of them still relied on the direct taxes such as corporate tax and. 300 006 18 GST amount. In February 2006 government has announced that the implementation would be postponed to a later date.

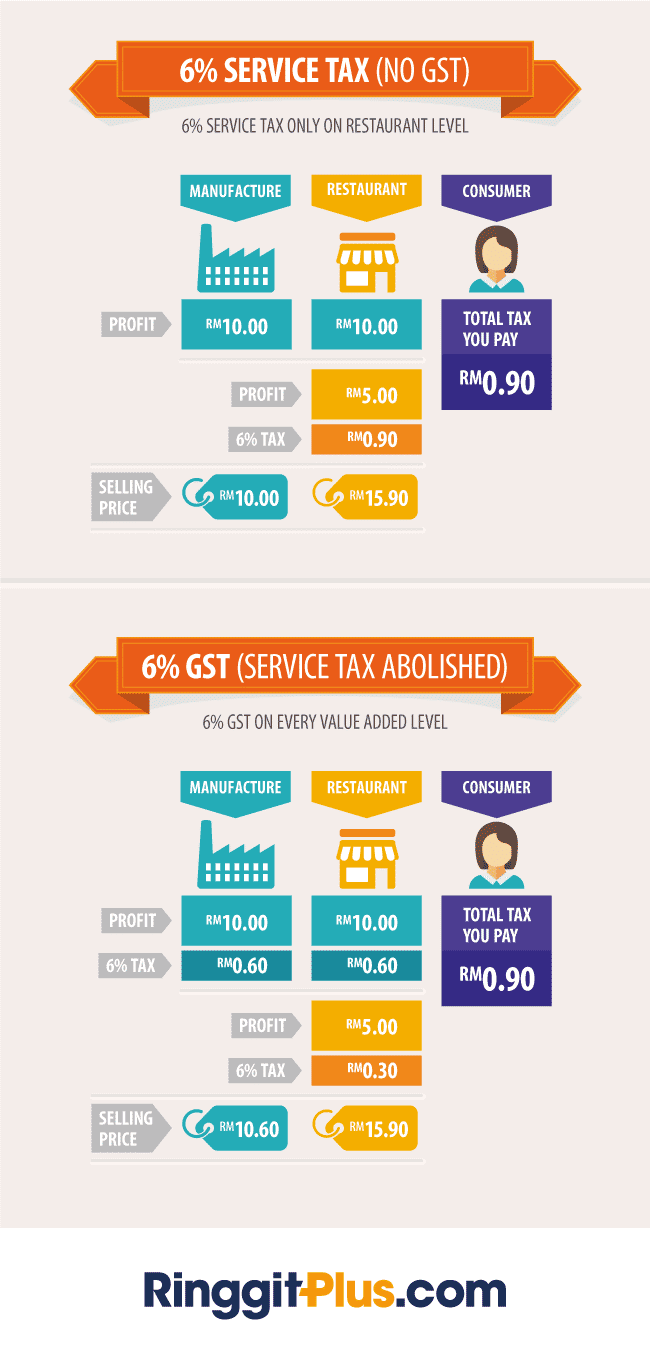

SST on the other hand has a cascading effect. To calculate Malaysian GST at 6 rate is very easy. GST is also called VAT - Value Added Tax in other countries Inflation may happen.

The earlier taxation structure ie sales and service tax which was 5-15 was reduced to 6 by GST implementation in Malaysia. Our study investigates how the introduction of the GST affected small and medium-sized enterprise SME owners in the retail sector. There are significant savings to be garnered from GST if we im- plement it correctly.

Goods and Service Tax in Malaysia is a single taxation system in the economy levied on all goods and services in the country. Here we have considered the must-dos. All the goods and services offered in the country would be charged at 6 tax.

The introduction of the six percent GST in Malaysia from April 1 2015 will bring forth radical changes to the Malaysian tax landscape. In Malaysia the implementation of GST is aimed to improve the revenue collection and reduce the nations growing budget deficit which ultimately could increase the standard of living among Malaysians as a whole. GST a broad-based tax was levied at six per cent on most supplies of goods and services consumed within Malaysia.

With Malaysia looking to establish its own regime Lachlan Wolfers Asia-Pacific regional leader for indirect taxes at KPMG explores the common pitfalls and looks at the lessons Malaysia can take from similar experiences in other jurisdictions. 300 is GST exclusive value. Their economic status and way of gaining revenue varies from Malaysia.

The GST also known as value added tax VAT in some countries is not a new concept of taxation as other countries in the region introduced GSTVAT years ago. The Malaysian government is planning to re-implement goods and services tax GST. Furthermore this might involve lowering the revenue rate or keeping it in a position where it is acceptable to the.

How to calculate Malaysian GST manually. Hence it is anticipated that the government isnt looking for an immediate change. Malaysias GST implementation a success.

GST was introduced in Malaysia on 1 April 2015 and replaced the Sales and Service Tax SST. R0277 with problems on the implementation of GST faced by SMEs that lead to GST withdrawal. Creases of 6 to take into account the GST.

Currently sales tax of 5 percent 20 percent and service tax of 6 percent are imposed on the domestic consumption of certain prescribed goods and services respectively on an ad valorem basis. Other countries such as Britain India Hong Kong Japan and Singapore has GST - Doesnt mean GST has to be implemented in Malaysia. The introduction of Goods and Service Tax GST was first announced in Malaysia Budget 2005 and then projected to be implement in January 2007.

An easy way to calculate GST on a product. Najib has guaranteed no inflation - But with the introduction of GST.

A Guide To Gst In Malaysia How Does It Affect Me

Gst Better Than Sst Say Experts

Malaysia May Reintroduce Gst Says Pm Ismail Sabri How Will Car Prices Be Affected Compared To Sst Paultan Org

Abolition Of Gst And Transition To Sst In Malaysia Activpayroll

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Do You Agree That Gst Should Be Implemented In Malaysia Tax Updates Budget Business News

Gst To Sst In Malaysia 3 Key Impacts Explained Infographic

Goods And Services Tax Malaysia Gst Ts Dr Mohd Nur Asmawisham Bin Alel

Implementation Of Goods And Service Tax Gst In Malaysia Yyc

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Gst 2 0 Better Late Than Never The Star

Gst What Is Happening To Taxes In Malaysia Gst Vs Sst Treezsoft Blog

Speeda Malaysia S Gst Effect Catalyst Or Deterrent Speeda

Difference Between Sst Gst Sst Vs Gst In Malaysia 2020 Updated

Implementation Of Goods And Service Tax Gst In Malaysia Yyc